ISSN

2307–3489 (Print), ІSSN

2307–6666

(Online)

Наука

та прогрес транспорту. Вісник

Дніпропетровського

національного університету залізничного

транспорту, 2016,

№

6

(66)

економіка

та управління

UDC

338.45:656.225

B.

FARKAS1*,

1*Dep.

«Faculty of Transportation Engineering and Vehicle Engineering»,

The Budapest University

of Technology

and Economics, Műegyetem rkp. 3, Budapest, Hungary, H-1111, tel. +36

1 (463) 10 51,

e-mail

farkas.balint@mail.bme.hu, ORCID 0000-0001-5388-9905

PRESENTATION OF

THE RAIL FREIGHT

MARKET’S CONCENTRATION WITH

RESPECT TO THE GAS

MARKET

WITH THE HELP OF THE HERFINDAL-

HIRSCHMAN INDEX

Purpose. To

demonstrate the current level of concentration on the rail freight

market and to find a feasible long-term way for its expansion and

progress by exploring and comparing it to another industrial branch

well ahead on the road of concentration. Methodology. To

identify an industrial branch being at an appropriate level of

concentration, therefore being suitable for the purpose. To adapt the

Herfindahl-Hirschman Index (HHI) for measuring the level of

concentration of the market. Finally, to make a series of comparisons

between the levels of concentrations of the two markets. Findings.

In terms of concentration of the market, the

liberalisation was more successful in the gas sector than in

the rail freight sector, in Hungary. Therefore, the Hungarian gas

sector is to be abandoned for comparison purposes and another, more

suitable should be picked. Figures in the charts and findings of the

application of the HH Index demonstrate that the

liberalisation process in the energetics sector in Estonia has

been most efficient. The methods of the Estonian process may be

applicable for reducing the level of concentration on the rail

freight market in Hungary. Originality. Novelty as far as the

application of the Herfindahl-Hirschman

Index for the purposes of the investigation is concerned. An

innovative approach to analyse the

structure of the rail freight market by a test, which has been unique

so far in Hungary. Practical value. By using a mathematical

method, a market suitable for testing can be selected. The results of

the analyses can be adopted for the purposes of the rail freight

market.

Keywords:

rail; gas; market; liberalization; Herfindahl-Hirschman Index;

freight

Introduction

In this paper we point out that

compared to other sectors ahead with the liberalization, the degree

of liberalization of rail freight can be defined. A possible way to

this comparison is the application of the Herfindahl-Hirschman Index

(hereinafter HHI). The HHI index shows the concentration of the

market, the lower the value the more liberalized the particular

market is. Our study will show that the liberalization of rail

freight cannot be considered satisfactory. To find a solution to

this problem, the method to be applied is that we examine the

liberalization processes of industries showing similarities to rail

freight with other, specific characteristics [14].

We will select an industry based

on some of the important features, and examine its process of

liberalization to receive guidance in the future on how the

liberalization of Hungarian rail freight can be made. In our article

we examine the natural gas service among the industries, and we will

compare this the rail freight on the basis of the HHI index. We will

introduce the HHI index, its forming’s mathematical method, and

what consequences can be drawn from it regarding the degree of

liberalization. Then we will determine the HHI index of the natural

gas industry and the rail freight. Based on this data we will point

out the differences and tendencies in numbers and draw conclusions.

The purpose of research.

The Hungarian rail freight as well as a number of other services

should be liberalized. One reason is that the liberalized market

creates the conditions for that the quality, the performance and the

low price should mean the competitive edge and not the speculative

instruments and the abuse of a dominant market position [1]. This is

the interest of the sector as it contributes to development, and

also the interest of the consumers as they can enjoy higher value

services with more choice besides a better price-performance ratio.

Because of all these reasons the

European Union (hereinafter EU) also provides directives for the

liberalization to the legislators. These directives are 91/440/EEC,

95/19/EK, «First Railway Package» (2001), «Second Railway

Package» (2004), «Third Railway Package» (2007), «Forth Railway

Package» (2013) [4]. These directives have gradually prescribed the

advancing of the liberalization process. The liberalization of

Hungarian rail freight has already begun, but not yet complete. The

long-term goal of our research is to find a solution to the question

of how the liberalization of Hungarian rail freight sector can be

continued [10]. For this we chose the method to examine the process

of liberalization in other industries which are already ahead of or

even been liberalized on an acceptable level [5].

The method. In this paper

we deal with that how to select the example industry, which industry

should we consider sample to find guidance to the further

liberalization of Hungarian rail freight. For this in the first

round we should find such industries, which are more similar to rail

freight with regard to characteristics. Such common characteristics

are, for example, that we talk about a service, which is associated

with a physical network, which network is multi-level depending on

how large area it covers. If we had found the market with these

characteristics, we would have needed to choose the most suitable

among them. We also judge this suitability with the degree of

liberalization, because only then we can conclude that the choice

described above is ahead to the liberalization process, that is,

whether we can draw progressive lessons from it? We determined the

degree of liberalization by using HHI. In this paper we are moving

forward in the above-described steps.

Choosing the appropriate

industry. The service sector similarly networked as rail, the

other infrastructure sectors, namely drinking water supply, natural

gas supply, district heating and electricity services [8]. There is

no nationwide network of district heating, but only local, so we can

ignore this sector. The remaining three has national and

international level as well. Among them the natural gas service has

both regional and national, and also international level, so we find

this sector suitable for further analysis, which determines the

degree of liberalization by using HHI [2].

Presentation

of Herfindahl-Hirschman Index (HHI).

The Herfindahl-Hirschman Index shows how

concentrated a particular market is, that is how well its shares are

distributed among the participants [3]. The more even the share of

the market participants is, the smaller the HHI is, and in case if

less participants have more shares, then the HHI will be higher. Its

forming is done by the sum of squares of the market operator’s

shares:

,

,

where

the

number of market operators;

the

number of market operators;

the share of

the share of

operator.

operator.

Its value is

between

and 1, or it is also usual to substitute

and 1, or it is also usual to substitute

with the number value of percentages, then the upper threshold is

10000, this is more expressive.

with the number value of percentages, then the upper threshold is

10000, this is more expressive.

We distinguish three levels of

classification of the markets’ concentration based on the HHI:

According to the US

classification:

– Non-concentrated

market: HHI below 1 500

– Less

concentrated market: HHI between 1 500 and 2 500

– Highly

concentrated market: HHI above 2 500

According to the Hungarian

classification:

– HHI below

1 000 – non-concentrated market

– HHI

between 1 000 and 1 800 – less concentrated market

HHI above 1800 – highly

concentrated market [12].

Presentation

of the calculation and its results. In

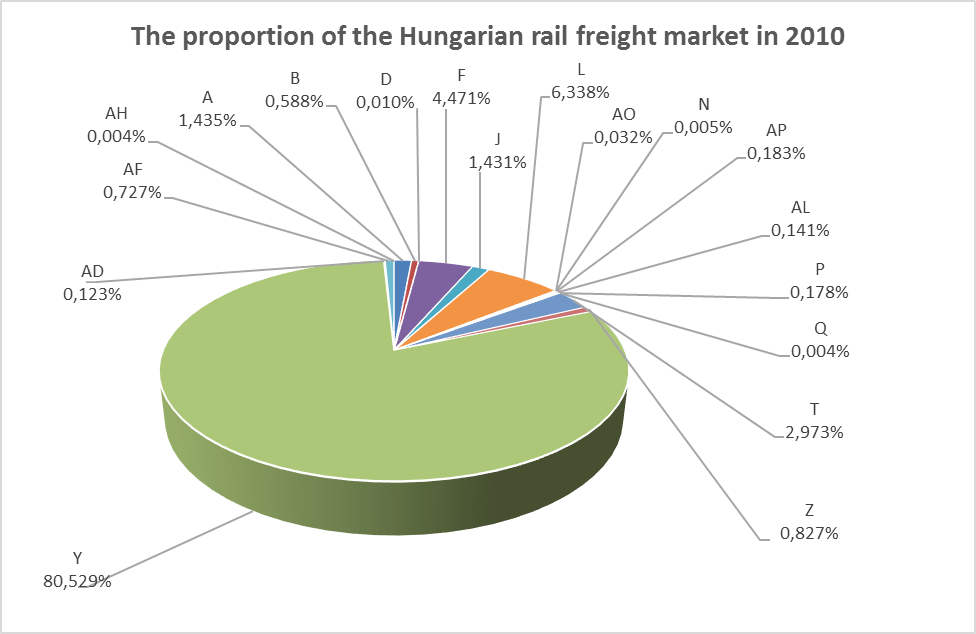

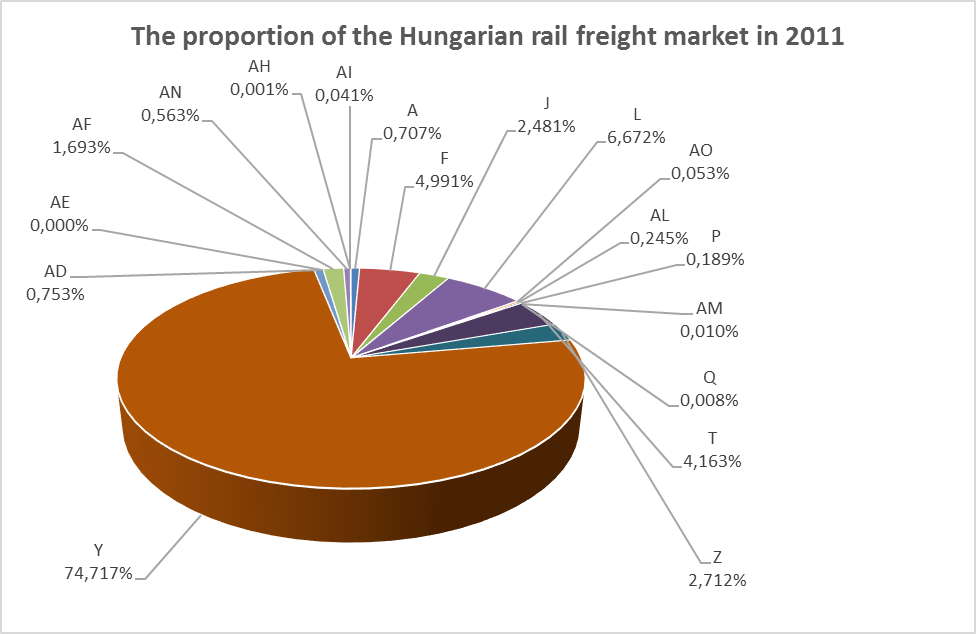

the following diagrams (see Fig. 1, Fig. 2,

Fig. 3, Fig. 4, Fig.

5, Fig. 6, Fig. 7, and Fig. 8) we can see the companies’ market

share of the natural gas service and the rail freight market. In the

following diagrams the letters are the names

of the rail freight market actors in Hungary (A, B, C, ...). The

figures show the percentage share calculated in freight ton-km

basis. After the graphics presenting the

certain years, in summary we will illustrate the evolution of HHI in

terms of rail freight and natural gas service, in the period from

2010 and 2015.

Fig. 1. The

proportion of the Hungarian rail freight market in 2010

Source:

own work (National Transport Authority)

Fig. 2. The

proportion of the Hungarian rail freight market in 2011

Source:

own work (National Transport Authority)

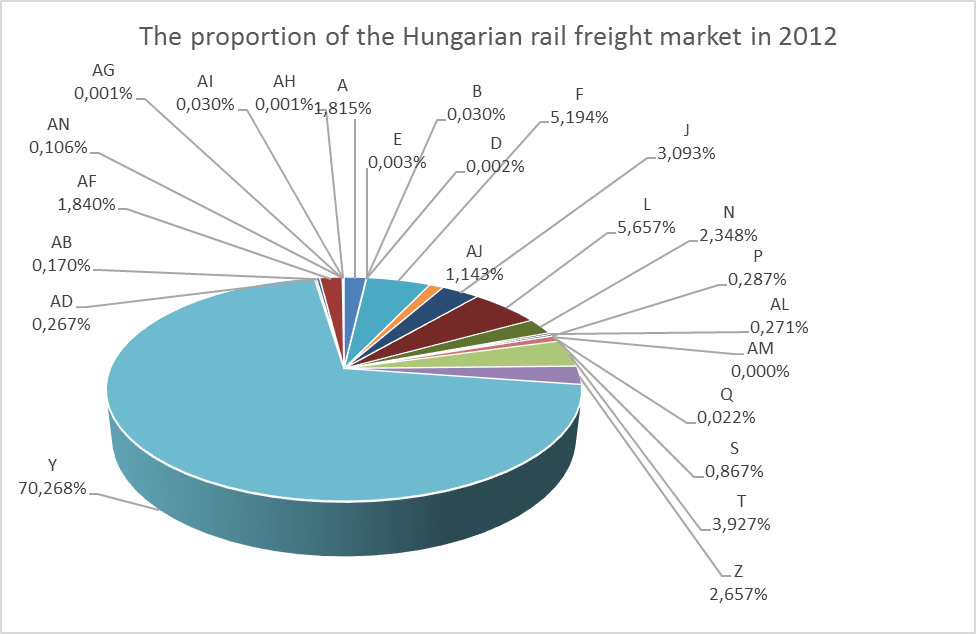

Fig. 3. The

proportion of the Hungarian rail freight market in 2012

Source:

own work (National Transport Authority)

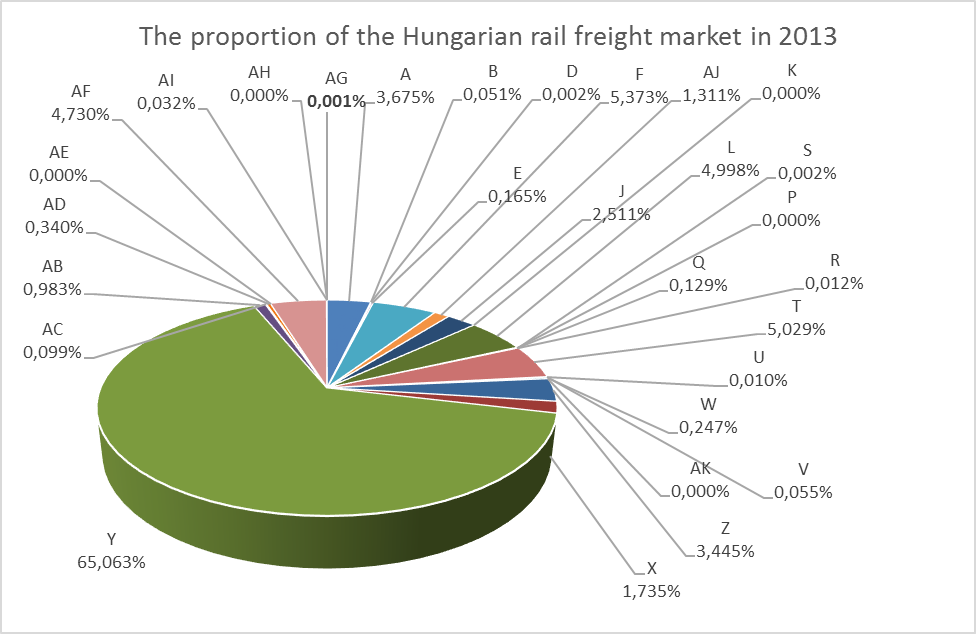

Fig. 4. The

proportion of the Hungarian rail freight market in 2013

Source:

own work (National Transport Authority)

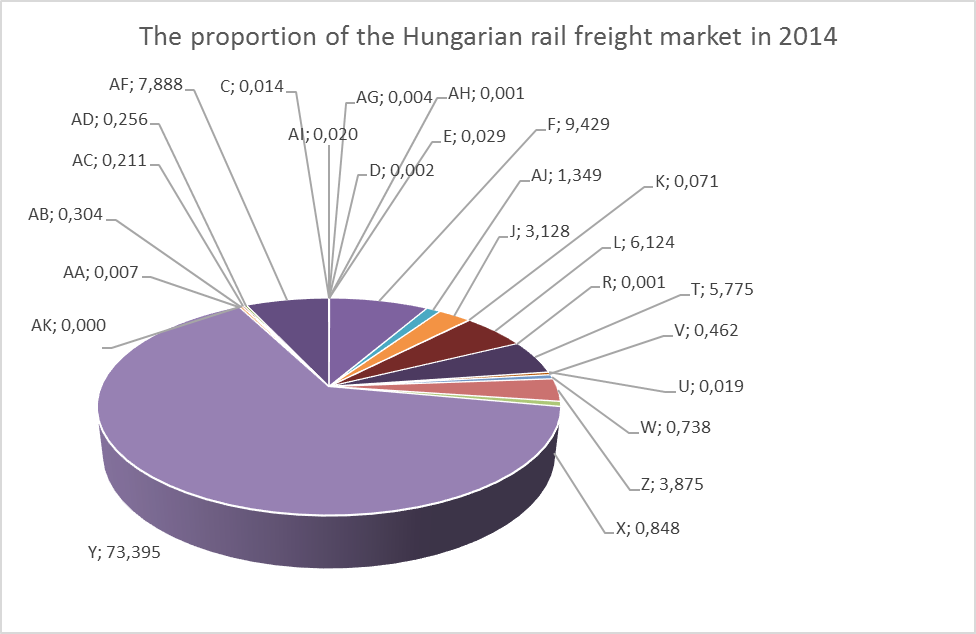

Fig. 5. The

proportion of the Hungarian rail freight market in 2014

Source:

own work (National Transport Authority)

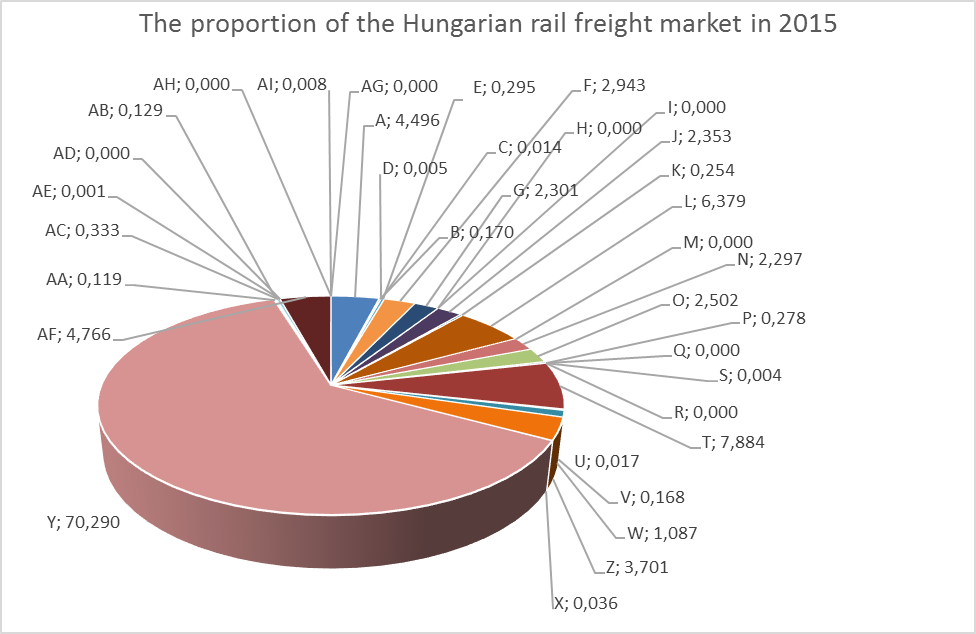

Fig. 6. The

proportion of the Hungarian rail freight market in 2015

Source:

own work (National Transport Authority)

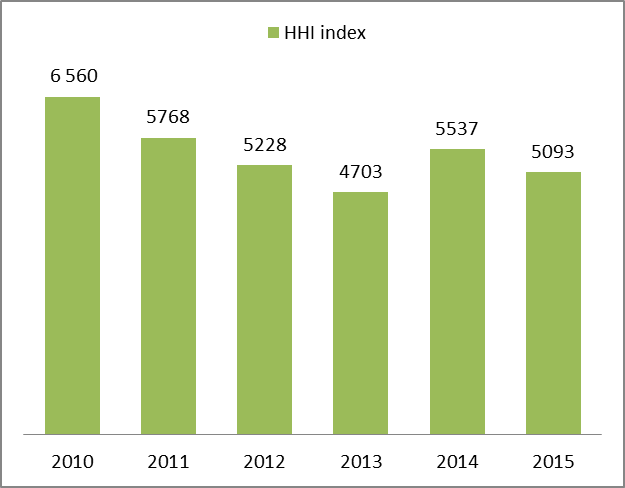

Fig. 7. The HHI

indexes of the Hungarian rail freight from 2010 to 2015 broken down

by years

Source: own work (National Transport Authority)

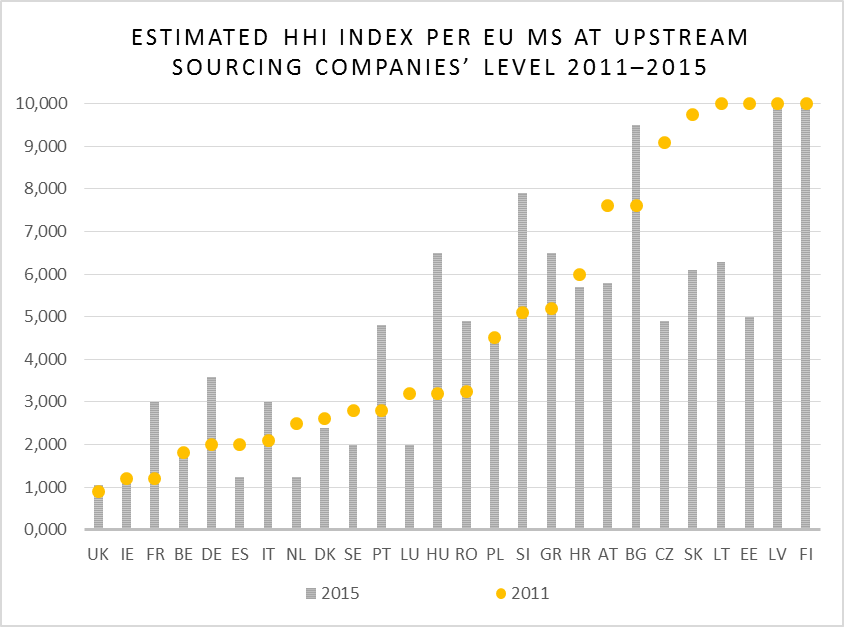

Fig. 8. The HHI

index of the European countries’ gas trade and market in 2011 and

in 2015

Source: ACER calculations based on Eurostat and Eurostat

Comext, BP Statistical Report, Frontier Consultancy desktop research

for GTM 2014 and NRAs data. (See annex 1 for methodology

clarification)

Rail

freight. The HHI index of rail freight

fluctuated between 4500 and 7000 in the period from 2010 to 2015

(Chart 1-6), showed a clear decrease until 2013 and then began to

rise (Chart 5). With these HHI indexes, unfortunately, the rail

freight market is in the «highly concentrated» category. This is

because the share of one of the market operators is overwhelming,

this company’s share affected the tendencies the most. From this

it is visible that the circle of market operators has steadily

expanded, this has not significantly improved the concentration of

the market since new entrants hold only a small share of the market.

The liberalization process is not satisfactory, the market

competition’s conditions of fair, quality and performance based,

serving the interest of the consumers in the long run are not met.

Natural gas service. From

Chart 9 can be concluded that Hungary had the largest increase in

market concentration from all EU Member States [13]. In Estonia,

however, it shows that it came back nearly 50% from the highest

concentration [6]. This is because of the good differentiation, the

choice of good product range and good economic decisions [9, 15].

Conclusions

All these show that the

liberalization of Hungarian rail freight still intends to continue.

The structure of the market is required to be homogenized to comply

with European Union directives and to make passible the development

of a healthy market competition bearing in mind the interest of

consumers. As a result of our research we can see that the

liberalization efforts have not been sufficiently successful in the

natural gas supply market [7]. By taking into account this and the

previous considerations, it can be said that it is not worthwhile

examine how the liberalization of this industry has been implemented

in Hungary. Instead, we must seek for another, more suitable example

of industry hereinafter. Or further studies would be necessary in

the energy liberalization of Estonia, because as the above figure

shows, Estonia could reduce its market concentration very well. As

another direction of our research, we will examine the gas industry

market and position of Estonia.

LIST OF REFERENCE LINKS

Bethlendi,

A. A hazai hitelpiac empirikus vizsgálata fejlődési irányok,

makrogazdasági és pénzügyi stabilitási következmények

:

PhD thesis / A. Bethlendi ; Budapesti Műszaki és

Gazdaságtudományi Egyetem Gazdálkodás- és Szervezéstudományi

Doktori Iskola.

–

Budapest, 2009. – P. 22–31.

Bointner,

R. Knowledge

in the energy sector: what R&D Expenditures and patents reveal

about innovation [Vortrag] / R. Bointner // 38th

IAEE Intern. Conf. (25.05–27.05.2015).

–

Türkei, Antalya, 2015. – P. 2.

Cutler,

D. M. Hospitals, Market Share, and Consolidation / D. M. Cutler, F.

S. Morton // JAMA. – 2013. – Vol. 310. – Iss. 18. –

P. 1964–1970. doi:10.1001/jama.2013.281675.

Duleba,

S. An Analysis on the connections of factors in a public transport

system by AHP-ISM / S. Duleba, Y. Shimazaki, T. Mishina //

Transport. – 2013. – Vol. 28. – Iss.

4. – P. 404–412. doi: 10.3846/16484142.2013.867282.

Gregor,

G. Generation Investments under Liberalized Conditions in the

Central and South-East European region / G. Gregor, A. Kiss,

A. Mezősi // Security of Energy Supply in Central and South-East

Europe / ed. P. Kaderák. – Budapest : REKK, 2011. –

P. 150–201.

Liberaliasation

of the Estonian Gas Market: A report to Elering AS [Electronic

resource]. – Oxford : Pöyry Management Consulting, 2011. – 154

p. – Available at:

http://www.poyry.com/sites/default/files/573_estonian_liberalisation_v1_0.pdf.

– Title from the screen. – Accessed : 04.10.2016.

Kiss,

A. Measures and Indicators of Regional Electricity and Gas Supply

Security in Central and South-East Europe / A. Kiss, A. Mezősi,

A. I. Tóth // Security of Energy Supply in Central and South-East

Europe / ed. P. Kaderák. – Budapest : REKK, 2011. – P. 8–51.

Kurmai,

V. A piaci verseny és koncentráció az almasűrítmény

világpiacán / V. Kurmai // Agrártudományi Közlemények. –

2016. – Iss. 69. – P. 129–133.

Ripple,

R. D. Global Natural gas markets: Prospects for US exports?

[Electronic resource] : presentation / R. D. Ripple // EIA Energy

Conf. (15.06–16.06.2015) / The University of Tulsa. –

Washington, 2015. – Available at:

https://www.eia.gov/conference/2015/pdf/presentations/ripple.pdf.

– Title from the screen. – Accessed : 03.01.2017.

Smith,

A. S. J. The Impacts of Economic Regulation on the Efficiency of

European Railway Systems / A. S. J. Smith, V. Benedetto,

C. A. Nash // 4th

White Rose Doctoral Training Centre Economics Conference

(27.03.2015) / University of Leeds. – Leeds, 2015. – P. 5.

Sugár,

A. A piacszabályozás elméleti és gyakorlati aspektusai

közszolgáltató szektorokban, elsősorban az energiaszektor

árszabályozása példáján : PhD thesis

/ A.

Sugár. –

Budapest

: Corvinus University of Budapest, 2011. – 27 p.

Uhrin,

G. A verseny intenzitásának mérhetősége [Mensurability of the

competition’s intensity] [Electronic resource] / G. Uhrin. – 40

p. – Available at:

http://www.gvh.hu/data/cms1000455/Uhrin%20G%C3%A1bor.pdf. – Title

from the screen. – Accessed : 05.10. 2016.

Vandewalle,

J. Natural gas in the energy transition. Technical challenges and

opportunities of natural gas and its infrastructure as a

flexibility-providing resource : Dissertation / J. Vandewalle.

– Leuven : KU, 2014. – 268 p.

Varga,

J. A versenyképesség többszintű elemzése az innovációval

való összefüggése : doktori (Ph.D) értekezés / J. Varga. –

Gödöllő : Szent István Egyetem, 2014. – 215 p.

Youngs,

R. The EU’s global climate and energy policies: gathering

momentum? / R. Young // FRIDE’s working papers. – 2013. –

№ 118. – P. 24. – Available at:

http://fride.org/download/WP_118_EU_global_climate_and_energy_policies.pdf.

– Title from the screen. – Accessed : 07.11.2016.

Б. Фаркас1*

1*Каф.

«Транспортное

машиностроение и автомобилестроение»,

Будапештский университет

технологий

и экономики, Műegyetem

rkp. 3, Будапешт , Венгрия,

H-1111, тел. +36 1 (463) 10 51,

эл.

почта farkas.balint@mail.bme.hu,

ORCID 0000-0001-5388-9905

ПРЕЗЕНТАЦИЯ

КОНЦЕНТРАЦИИ ГРУЗОВОГО

ЖЕЛЕЗНОДОРОЖНОГО

РЫНКА В ОТНОШЕНИИ

ГАЗОВОГО РЫНКА С

ПОМОЩЬЮ ИНДЕКСА

ХЕРФИНДАЛЯ-ХИРШМАНА

Цель.

Данная статья имеет своей целью

продемонстрировать текущий уровень

концентрации рынка железнодорожных

грузовых перевозок и найти целесообразный

постоянный способ его расширения и

продвижения, исследуя и сравнивая его

с другими промышленными отраслями,

которые достигли значительных успехов

на пути к концентрации рынка. Методика.

В работе необходимо: 1) определить

промышленную отрасль, находящуюся на

соответствующем уровне концентрации,

и, следовательно, пригодную для этой

цели; 2) адаптировать индекс концентрации

Херфиндаля-Хиршмана (ИХХ) для измерения

уровня концентрации рынка; 3) сделать,

наконец, ряд сравнений уровней

концентраций двух рынков. Результаты.

С точки зрения концентрации рынка в

Венгрии либерализация была более

успешной в газовой отрасли, чем в отрасли

железнодорожных грузовых перевозок.

Поэтому венгерскую газовую отрасль

следует исключить из сравнения и выбрать

другую, более подходящую. Цифры,

приведенные в таблицах, и результаты

применения ИХХ свидетельствуют о том,

что процесс либерализации в отрасли

энергетики Эстонии был наиболее

эффективным. Для снижения уровня

концентрации на рынке грузовых

железнодорожных перевозок в Венгрии

могут быть применены методы либерализации

Эстонии. Научная новизна.

В статье впервые рассматривается

применение индекса Херфиндаля-Хиршмана

для целей исследования. Используется

инновационный подход к анализу структуры

рынка железнодорожных грузовых перевозок

с помощью теста, который до сих пор был

уникальным для Венгрии.

Практическая значимость.

С использованием математического

метода можно выбрать подходящий для

тестирования рынок. Результаты анализов

могут использоваться для целей рынка

железнодорожных грузовых перевозок.

Ключевые

слова: железная дорога; газ; рынок;

либерализация; индекс Херфиндаля-Хиршмана;

грузоперевозки

Б.

ФАРКАС1*

1*Каф.

«Транспортне машинобудування і

автомобілебудування», Будапештський

університет

технологій

і економіки, Műegyetem rkp. 3, Будапешт,

Угорщина, H-1111, тел. +36 1 (463) 10 51,

ел.

пошта farkas.balint@mail.bme.hu, ORCID 0000-0001-5388-9905

ПРЕЗЕНТАЦІЯ

КОНЦЕНТРАЦІЇ ВАНТАЖНОГО

ЗАЛІЗНИЧНОГО

РИНКУ ЩОДО ГАЗОВОГО

РИНКУ ЗА ДОПОМОГОЮ

ІНДЕКСУ ХЕРФІНДАЛЯ-

ХІРШМАНА

Мета.

Дана стаття має за мету продемонструвати

поточний рівень концентрації ринку

залізничних вантажних перевезень та

знайти доцільний постійний спосіб його

розширення і просування, досліджуючи

й порівнюючи його з іншими промисловими

галузями, які досягли значних успіхів

на шляху до концентрації ринку. Методика.

У роботі необхідно: 1) визначити

промислову галузь, що знаходиться на

відповідному рівні концентрації, і,

отже, придатну для цієї мети; 2) адаптувати

індекс концентрації Херфіндаля-Хіршмана

(ІХХ) для вимірювання рівня концентрації

ринку; 3) зробити, нарешті, ряд порівнянь

рівнів концентрацій двох ринків.

Результати.

З точки зору концентрації ринку в

Угорщині лібералізація була більш

успішною в газовій галузі, ніж в галузі

залізничних вантажних перевезень. Тому

угорську газову галузь слід виключити

з порівняння та вибрати іншу, більш

відповідну. Цифри, наведені в таблицях,

і результати застосування ІХХ свідчать

про те, що процес лібералізації у галузі

енергетики Естонії був найбільш

ефективним. Для зниження рівня

концентрації на ринку вантажних

залізничних перевезень в Угорщині

можуть бути застосовані методи

лібералізації Естонії. Наукова

новизна.

У статті вперше розглядається застосування

індексу Херфіндаля-Хіршмана для мети

дослідження. Використовується

інноваційний підхід до аналізу структури

ринку залізничних вантажних перевезень

за допомогою тесту, який досі був

унікальним для Угорщини. Практична

значимість.

З використанням математичного методу

можна вибрати відповідний для тестування

ринок. Результати аналізів можуть

використовуватися для цілей ринку

залізничних вантажних перевезень.

Ключові

слова:

залізниця; газ; ринок; лібералізація;

індекс Херфіндаля-Хіршмана;

вантажоперевезення

REFERENCES

Bethlendi

A. A hazai hitelpiac empirikus vizsgálata fejlődési irányok,

makrogazdasági és pénzügyi stabilitási következmények

[Empirical research of the interior credit market, direction of

development, macro economical and financial stability

consequences]: PhD thesis. Budapesti Műszaki és Gazdaságtudományi

Egyetem Gazdálkodás- és Szervezéstudományi Doktori Iskola

[Doctoral School of Business and Management, Budapest University of

Technology and Economics]. Budapest, 2009, pp. 22-31.

Bointner

R. Knowledge

in the energy sector: what R&D Expenditures and patents reveal

about innovation [Vortrag]. 38th

IAEE Intern. Conf. (25.05–27.05.2015).

Türkei, Antalya, 2015. P. 2.

Cutler

D.M., Morton F.S. Hospitals, Market Share, and Consolidation. JAMA,

2013, vol. 310, issue 18, pp. 1964-1970.

doi:10.1001/jama.2013.281675.

Duleba

S., Shimazaki Y., Mishina T. An Analysis on the connections of

factors in a public transport system by AHP-ISM. Transport,

2013, vol. 28, issue

4, pp. 404-412. doi: 10.3846/16484142.2013.867282.

Gregor

G., Kiss A., Mezősi A. Generation Investments under Liberalized

Conditions in the Central and South-East European region. Security

of Energy Supply in Central and South-East Europe. Ed. P. Kaderák.

Budapest, REKK Publ., 2011, pp. 150-201.

Liberaliasation

of the Estonian Gas Market: A report to Elering AS Oxford: Pöyry

Management Consulting, 2011. 154 p. Available at:

http://www.poyry.com/sites/default/files/573_estonian_liberalisation_v1_0.pdf

(Accessed 04 October 2016).

Kiss

A., Mezősi A., Tóth A.I. Measures and Indicators of Regional

Electricity and Gas Supply Security in Central and South-East

Europe. Security of Energy Supply in Central and South-East Europe.

Ed. P. Kaderák. Budapest, REKK Publ., 2011, pp. 8-51.

Kurmai

V. A piaci verseny és koncentráció az almasűrítmény

világpiacán [The market competition and concentration on the

global market of the appleconcentrate]. Agrártudományi

Közlemények – Acta

Agraria Debreceniensis, 2016, issue

69, pp. 129-133.

Ripple

R. D. Global Natural gas markets: Prospects for US exports?:

presentation. EIA Energy Conf. (15.06–16.06.2015). The University

of Tulsa. Washington, 2015. Available at:

https://www.eia.gov/conference/2015/pdf/presentations/ripple.pdf

(Accessed 03 January 2017).

Smith

A.S.J., Benedetto

V., Nash C.A.

The Impacts of Economic Regulation on the Efficiency of European

Railway Systems. 4th

White Rose Doctoral Training Centre Economics Conference

(27.03.2015). University of Leeds. Leeds Publ., 2015. P. 5.

Sugár

A. A piacszabályozás elméleti és gyakorlati aspektusai

közszolgáltató szektorokban, elsősorban az energiaszektor

árszabályozása példáján [The theoretic and practical aspects

of the market regulation in the public service sectors, primely as

an example of the price regulation of the energy sector]: PhD

thesis. Budapest,

Corvinus University of Budapest Publ., 2011. 27 p.

Uhrin

G. A verseny intenzitásának mérhetősége [Mensurability of the

competition’s intensity]. 40 p. Available at:

http://www.gvh.hu/data/cms1000455/Uhrin%20G%C3%A1bor.pdf (Accessed

05 October 2016).

Vandewalle

J. Natural gas in the energy transition. Technical challenges and

opportunities of natural gas and its infrastructure as a

flexibility-providing resource: Dissertation. Leuven, KU Publ.,

2014. 268 p.

Varga

J. A versenyképesség többszintű elemzése az innovációval

való összefüggése [Multilevel analysis of the competitivness

and the corelation with the innovation]: doktori (Ph.D) értekezés.

Gödöllő, Szent István Egyetem Publ., 2014. 215 p.

Youngs

R. The EU’s global climate and energy policies: gathering

momentum? FRIDE’s working papers. 2013, no. 118, pp. 24.

Available at:

http://fride.org/download/WP_118_EU_global_climate_and_energy_policies.pdf

(Accessed 07 November 2016).

Dr. habil. Duleba Szabolcs,

Budapest University of Technology and Economics (Hungary); Prof. S.

V. Myamlin, D. Sc. (Tech.) (Ukraine) recommended this article to be

published

Received: Sep. 30, 2016

Accepted: Dec. 05, 2016

,

the

number of market operators;

the share of

operator.

and 1, or it is also usual to substitute

with the number value of percentages, then the upper threshold is

10000, this is more expressive.